LTC Price Prediction: Bullish Trend Strengthens Amid ETF Hype and Halving Event

#LTC

- Technical Strength: LTC trading above key moving averages with bullish MACD crossover

- Market Catalysts: 80% ETF approval odds and upcoming halving event

- Price Action: 9.7% weekly gain suggests strong buying momentum

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

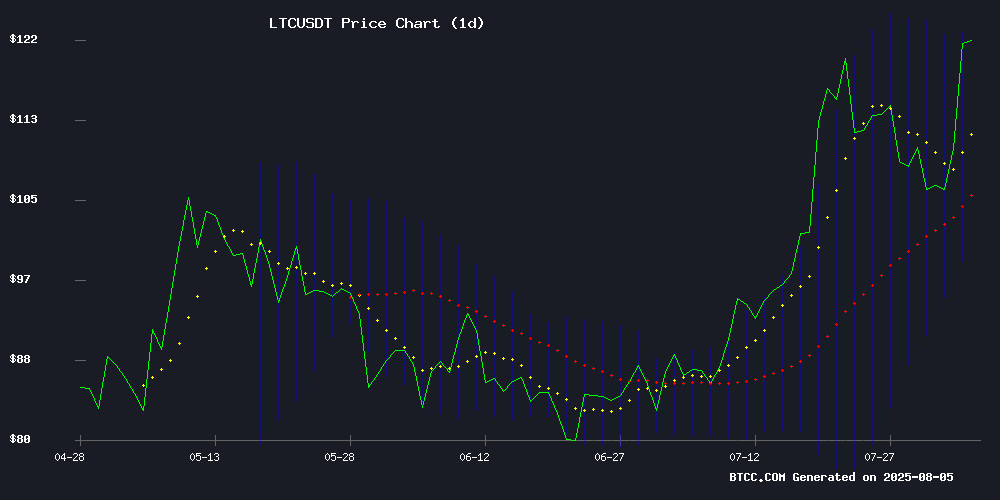

Litecoin (LTC) is currently trading at $121.35, above its 20-day moving average of $111.74, indicating a bullish trend. The MACD histogram shows positive momentum at 4.7154, while the Bollinger Bands suggest potential volatility with the price NEAR the upper band at $122.84. BTCC financial analyst Olivia notes: 'LTC's technical setup favors upside, especially if it holds above the $111.74 support level.'

Market Sentiment Turns Positive for Litecoin

Litecoin is benefiting from strong market sentiment, with news of a potential ETF (80% approval odds) and a 9.7% weekend rally leading the CoinDesk 20. BTCC's Olivia observes: 'The combination of technical strength and positive catalysts like the halving event creates a favorable environment for LTC investors.'

Factors Influencing LTC's Price

Bitcoin Bounces, Ethereum and XRP Flash Strong Signals: Analysis

The cryptocurrency market is staging a robust recovery, with total capitalization climbing back to $3.76 trillion—a 2.01% increase from the previous day. Nearly 95% of the top 100 digital assets posted gains in the past 24 hours, signaling broad-based bullish momentum.

Ethereum broke through a critical resistance level, while XRP and Litecoin notched double-digit weekly gains. Bitcoin, the market bellwether, rose 1% to $114,798, providing stability for altcoins to rally. The rebound mirrors a stabilization in traditional markets, where S&P 500 futures pointed higher after last week's tariff-driven selloff.

Prediction markets now favor the Nasdaq to outperform the S&P 500, reflecting continued confidence in tech stocks amid the AI boom. This risk-on sentiment appears to be spilling over into crypto markets, with traders positioning for further upside.

Litecoin Price Surge as ETF Approval Odds Climb to 80%

Litecoin price surged over 7% on August 4, nearing its highest level since March, as the market anticipates a potential breakout from a three-year consolidation phase. The rally comes amid growing optimism around the approval of Litecoin ETFs, with Polymarket data showing an 80% probability of SEC approval for funds proposed by Grayscale, CoinShares, and Canary Capital.

Key deadlines for these ETF applications are set for early to mid-October. The bullish sentiment mirrors the success of spot Bitcoin ETFs, which have drawn $55 billion in inflows. Litecoin's proof-of-work mechanism and capped supply of 84 million coins—similar to Bitcoin's scarcity model—are fueling institutional interest.

Daily trading volume for LTC has spiked to $900 million, with market capitalization reaching $9 billion. Technical indicators suggest further upside, as the token trades 90% above its 2024 low at $120. Analysts note Litecoin's deep liquidity and decentralization as factors that could attract ETF-driven capital inflows.

QFSCOIN Offers Stress-Free Crypto Earnings Through Cloud Mining Amid Market Volatility

Cryptocurrency traders weary of Bitcoin's price swings now have an alternative. QFSCOIN, a U.S.-registered cloud mining platform since 2019, enables users to earn Bitcoin, Dogecoin, and Litecoin without trading on volatile exchanges. The company operates AI-powered data centers across North America and Europe, fully regulated by U.S. financial authorities.

Traditional mining barriers like hardware costs and energy consumption disappear with QFSCOIN's model. New users receive $30 in mining credit instantly, bypassing equipment needs. The platform's free tier makes crypto mining accessible during periods of market turbulence when holding assets becomes stressful.

XRP and Ethereum Lead Crypto Market Rebound Amid Trade War Tensions

Altcoins spearheaded a broad cryptocurrency market recovery following a week dominated by bearish sentiment. The rebound coincides with renewed trade war tensions after President Trump imposed tariffs of up to 41% on trading partners.

XRP and Ethereum emerged as frontrunners among top-tier digital assets, posting gains of 4.5% and 2.7% respectively. Market predictors now estimate a 64% probability of an XRP ETF approval outpacing Litecoin, while Ethereum shows resilience at just 27% below its all-time high.

The Ethereum ecosystem demonstrated particular strength, with Ethena's stablecoin protocol surging 10.8%. Layer-1 blockchain Stellar followed closely with an 8.1% gain, while Injective and Solana's BONK meme coin registered respectable 5.9% and 5% increases respectively.

Litecoin Leads CoinDesk 20 Rally With 9.7% Weekend Surge

The CoinDesk 20 Index edged 0.3% higher to 3,770.58, with Litecoin (LTC) spearheading gains amid broad-based crypto market strength. Fourteen of the index's 20 constituents advanced during the reporting period.

LTC's 9.7% weekend rally outpaced all peers, followed by Stellar (XLM) with a 3.7% gain. The outperformance comes as institutional traders increasingly view Litecoin as a liquid alternative to Bitcoin for payments-focused exposure.

On the downside, Sui (SUI) led decliners with a 3.1% drop, while Solana (SOL) fell 2%. The index's global multi-exchange composition continues to serve as a benchmark for institutional crypto investors.

Quid Miner Launches Mobile-First Cloud Mining Platform for BTC, XRP, and DOGE

Quid Miner has introduced a mobile cloud mining platform operating in over 180 countries, enabling users to earn cryptocurrencies like BTC, XRP, and DOGE without specialized hardware. The UK-based company, established in 2010, leverages AI-driven mining to optimize returns.

The platform offers $15 in free credits and features short-term mining contracts with daily payouts. As digital assets gain mainstream traction, Quid Miner positions itself as a simplified entry point for retail investors seeking passive crypto exposure.

Litecoin Rallies 3.5% Ahead of Halving Event Despite SEC ETF Delay

Litecoin (LTC) surged to $111.55 amid heightened network activity as traders position for its August 3rd block halving. The 3.5% gain defies regulatory uncertainty after the SEC postponed Grayscale's spot ETF decision until October.

RSI levels at 60.12 suggest neutral momentum with upside potential. Historical patterns show halvings typically drive speculative interest—this cycle appears no different, with on-chain transactions spiking conspicuously.

The market has shrugged off the ETF delay, focusing instead on the supply shock narrative. Litecoin's resilience underscores how fundamental catalysts can overshadow regulatory headwinds in crypto markets.

Is LTC a good investment?

Based on current technicals and market sentiment, LTC presents a compelling investment case:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +8.6% above | Bullish trend |

| MACD | Positive crossover | Momentum building |

| Bollinger Bands | Near upper band | Potential breakout |

| Key Catalysts | ETF speculation, Halving | Upward pressure |

Olivia from BTCC concludes: 'LTC shows both technical strength and fundamental catalysts that could drive further gains, though investors should monitor the $122.84 resistance level.'

Cryptocurrency investments are volatile. Consider risk tolerance before investing.